- How to make phishing page online install#

- How to make phishing page online full#

How to make phishing page online full#

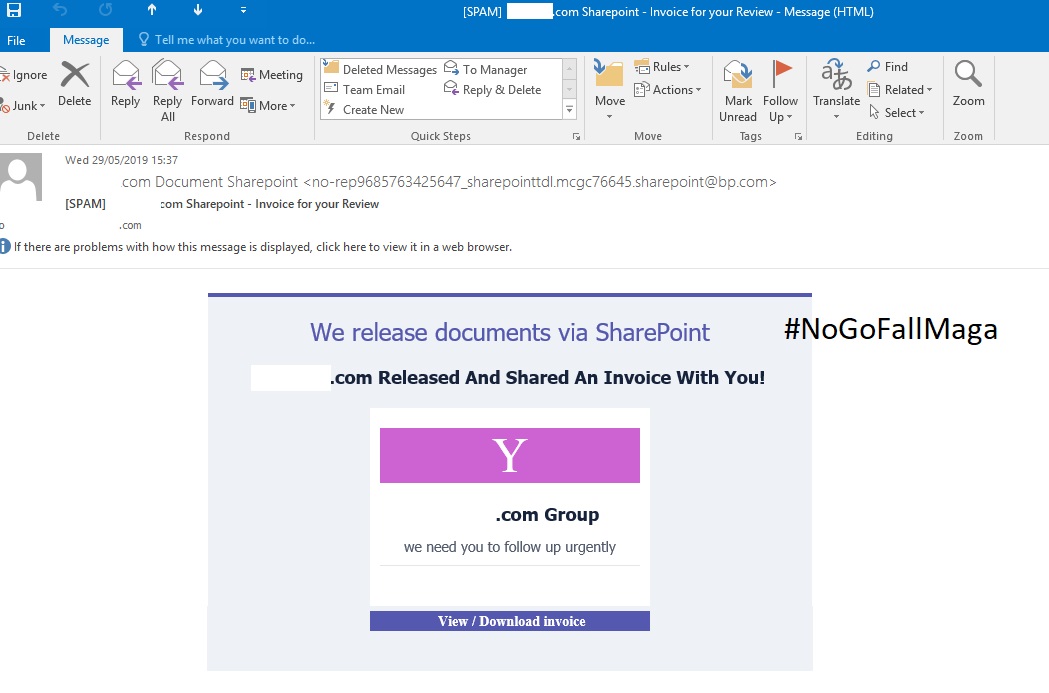

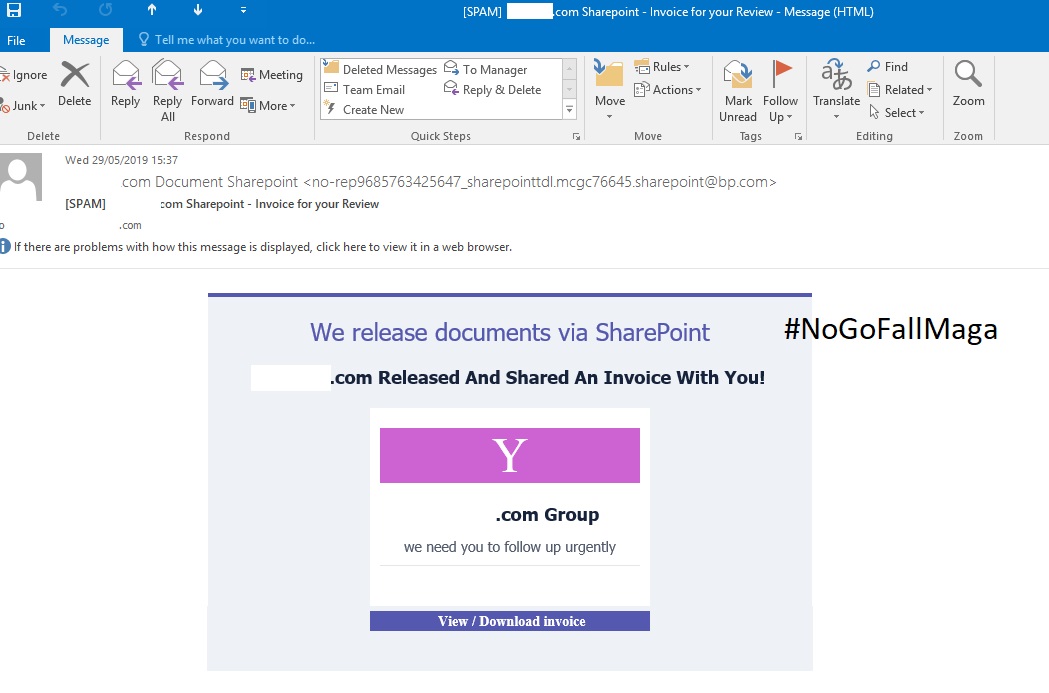

Ask for personal information like credit or debit card numbers, bank account information, driver’s license number, passwords or your full name.Start with a generic greeting instead of your name.You may already have a good eye for fake emails but just in case, watch out for ones that:

How to make phishing page online install#

Open attachments that install malicious software on your computer when opened or. One of the most common phishing scams involves sending an email that claims to be from a well-known company - like PayPal. Here are a few things to watch out for, to help make sure you don’t fall for these types of scams.ġ. Phishing is an attempt to gain access to your sensitive data via fake emails, websites, text messages, or voicemails. If you report the W2 scam to please clarify if you are a victim.When scammers make communications look, feel, and sound like the reputable organization they’re impersonating, it’s known as spoofing. If you are a recipient of this scam but did not send any information please send the full email headers to (Subject: W2 Scam). If you are a victim of this (e.g., you responded by sending the W2s) please email and also send the full email headers to (Subject: W2 Scam). You can report the W2 variant to the IRS – whether you are a victim or not – and should also report any BEC/BES variants to the Internet Crime Complaint Center ( ). Please only contact the IRS for the W2 variant. There are multiple variants of this scam (e.g., wire transfer, title/escrow, fake invoice, etc.). Since 2016, has received emails from organizations that have been targeted by the business email compromise (BEC) / business email spoofing (BES) W2 scam. Your local Attorney General’s office via their consumer complaint form (the reporting mechanism will vary by state). Consumers should select the “phone” form and then the “Unwanted Calls” under “Phone Issues”, and provide details of the call in the description of their complaint Federal Communications Commission (FCC) by visiting the Consumer Complaint Center. Federal Trade Commission (FTC) via their online complaint form. In addition, please consider filing a complaint with the: The geographic location and time zone where you received the call if possible. The exact date and time that you received the call(s). A brief description of the communication. The telephone number you were instructed to call back. The telephone number of the caller (e.g., Caller ID). When you report the fraudulent call, please include: If Treasury-related, please report to the Office of the Treasury Inspector General (TIG) via report IRS or Treasury-related fraudulent calls to (Subject: IRS Phone Scam).įor any fraudulent call, after listening to the message, do not provide any information and hang up.

If IRS-related, please report to the Treasury Inspector General for Tax Administration (TIGTA) via their online complaint form.If the individual is not an IRS employee and does not have a legitimate need to contact you and regardless of whether you were a victim of the scam or not, report the incident to the appropriate law enforcement agencies: If the caller is an IRS employee with a legitimate need to contact you, please call them back using the appropriate online resources.View your tax account information online or review their payment options at IRS.gov to see the actual amount owed.If you receive a phone call from someone claiming to be from the IRS but you suspect they are not an IRS employee: While the IRS does not endorse any solution or brand, a limited sample of the available options are:

Easy to install call blocking software for smartphones is available. Blocking these types of calls is one strategy taxpayers should consider. IRS impersonation telephone calls – as well as other types of unwanted calls (e.g., telemarketing robocalls, fake grants, tech support, sweepstakes winnings, etc.) remain popular scams.

0 kommentar(er)

0 kommentar(er)